Executive Snapshot

Tariff policy has shifted sharply in the past 18 months, squeezing margins for U.S. discrete-manufacturing plants. Metal duties remain in force, a new 25% levy on imported vehicles and parts took effect this spring, and Chinese imports have risen at an astounding rate.

Manufacturing executives have already begun taking action, flexing their supply chain muscles to identify new sources of material, bring manufacturing back to the US, and, in many cases, simply stockpiling resources before material prices raise.

Alternatively, others have seen a greater impact from inflation than they have from tariffs.

This article breaks down some of the most recent news on tariffs for US manufacturers and provides several strategies for mitigating the impact.

The 2025 Tariff Landscape

- Trump-era “baseline” tariffs. As of April 2, 2025 the White House imposed a blanket 10% duty on most imports, with country-and-sector surcharges that push Chinese goods as high as 54%.

- Auto-specific shock. A separate 25% tariff on vehicles and major components - Chinese parts excluded from all relief - hit on April 3, forcing automakers to plead for credits worth up to 15% of vehicle value.

- Aluminum and Steel tariffs double: Tariffs on steel and aluminum products have jumped to 50% for all countries except for UK-origin products, which remain at 25%.

Figure 3 illustrates the tariff burden across sectors under the full set of 2025 tariffs, including the April 2 measures. [Source: Federal Reserve Bank of Richmond]

Figure 3 illustrates the tariff burden across sectors under the full set of 2025 tariffs, including the April 2 measures. [Source: Federal Reserve Bank of Richmond]

Where the Pain Hits the Plant

Material & Component Costs

- Metals: Global aluminum and steel suppliers are reeling at the latest doubling of tariffs (to 50%) that went into affect June 4. UK origin products will stay at 25%.

- Electronics: On Jan 1 2025, Section 301 doubled many chip tariffs to 50%; PCBs/LEDs remain at 25%.

- Plastics: North-American PP and PET prices jumped 4–6 ¢/lb (~5–6%) in Jan–Feb 2025, with suppliers pointing to tariff uncertainty as a driver

The reality: almost every bill-of-materials line item, from steel plate to tiny magnets, is now subject to double-digit uplifts unless domestically sourced or excluded.

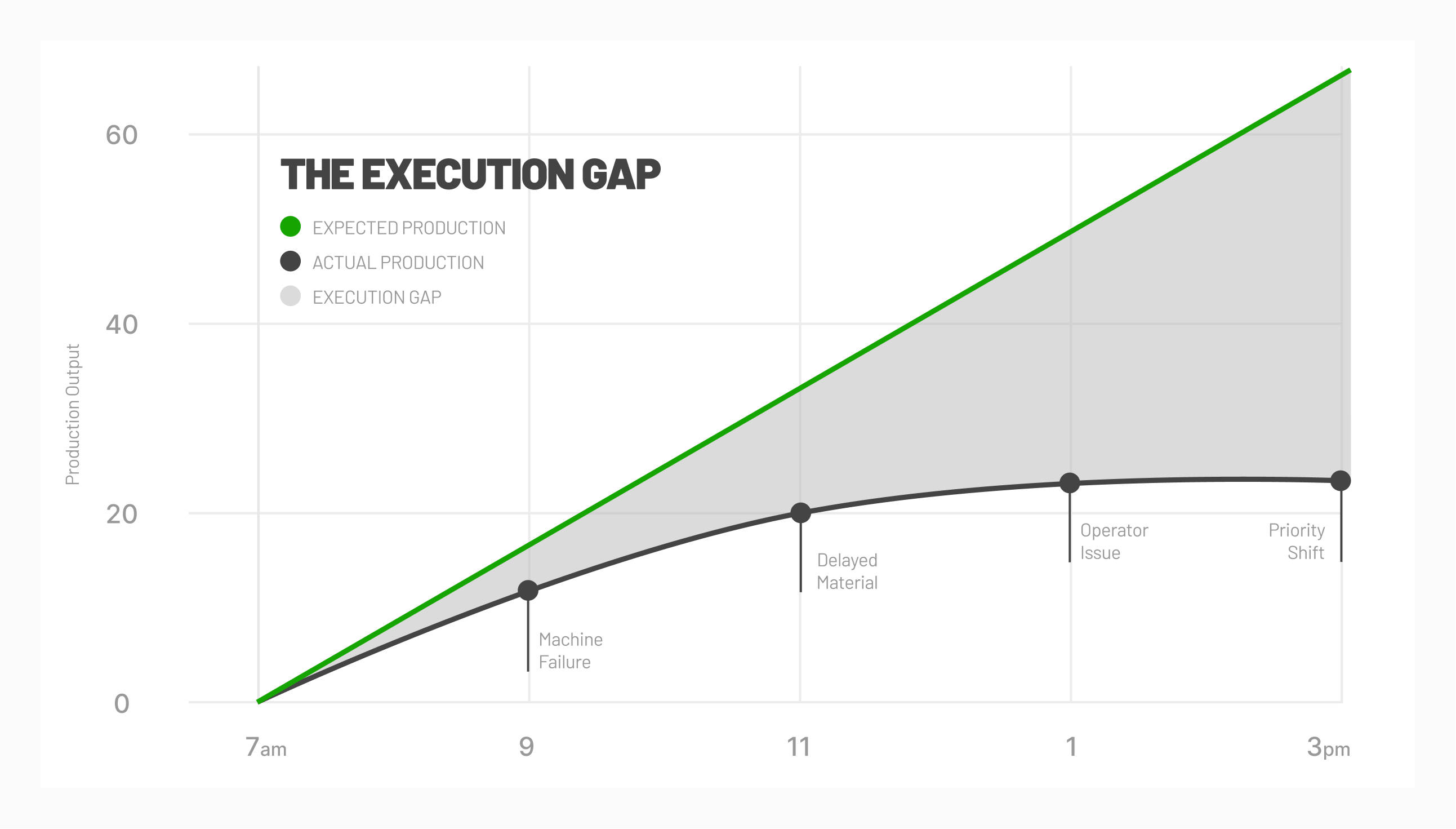

Inventory & Scheduling Whiplash

Manufacturers have front-loaded shipments ahead of tariff start dates, stockpiled specialty parts, and then faced stop-and-go lines when exclusions lapsed, hurting performance and inflating working capital.

Margin Squeeze

NAM’s Q1-2025 survey shows 76% of U.S. manufacturers list ‘trade uncertainty’ as their top concern, up 40 points year-over-year, while 62% cite raw-material cost inflation. Both small and large firms are feeling the pain: GE Aerospace expects >$500 million in annual tariff costs; RTX pegs the hit at $850 million.

Tariff Mitigation Strategies

Many leaders have already begun to take action. Below are some of the core mitigation strategies US discrete manufacturers are deploying with varying degrees of success.

| Strategy |

Notes |

Proof Point |

| "China + 1" & Multisourcing |

Qualify at least two alternate suppliers for every tariff-exposed SKU. |

32% of global business leaders are building dual supply chains - explicitly branded as a “China + 1” strategy. |

| Near & Reshoring CapEx |

When tariffs and logistics add low-teens percentages to cost of goods, shifting final assembly to North America typically pays back inside three years. |

Toyota is preparing to shift assembly of its next-generation RAV4 SUV to its Georgetown, KY complex - a $1 billion re-tooling move - to sidestep the new 25% tariff on imported vehicles. |

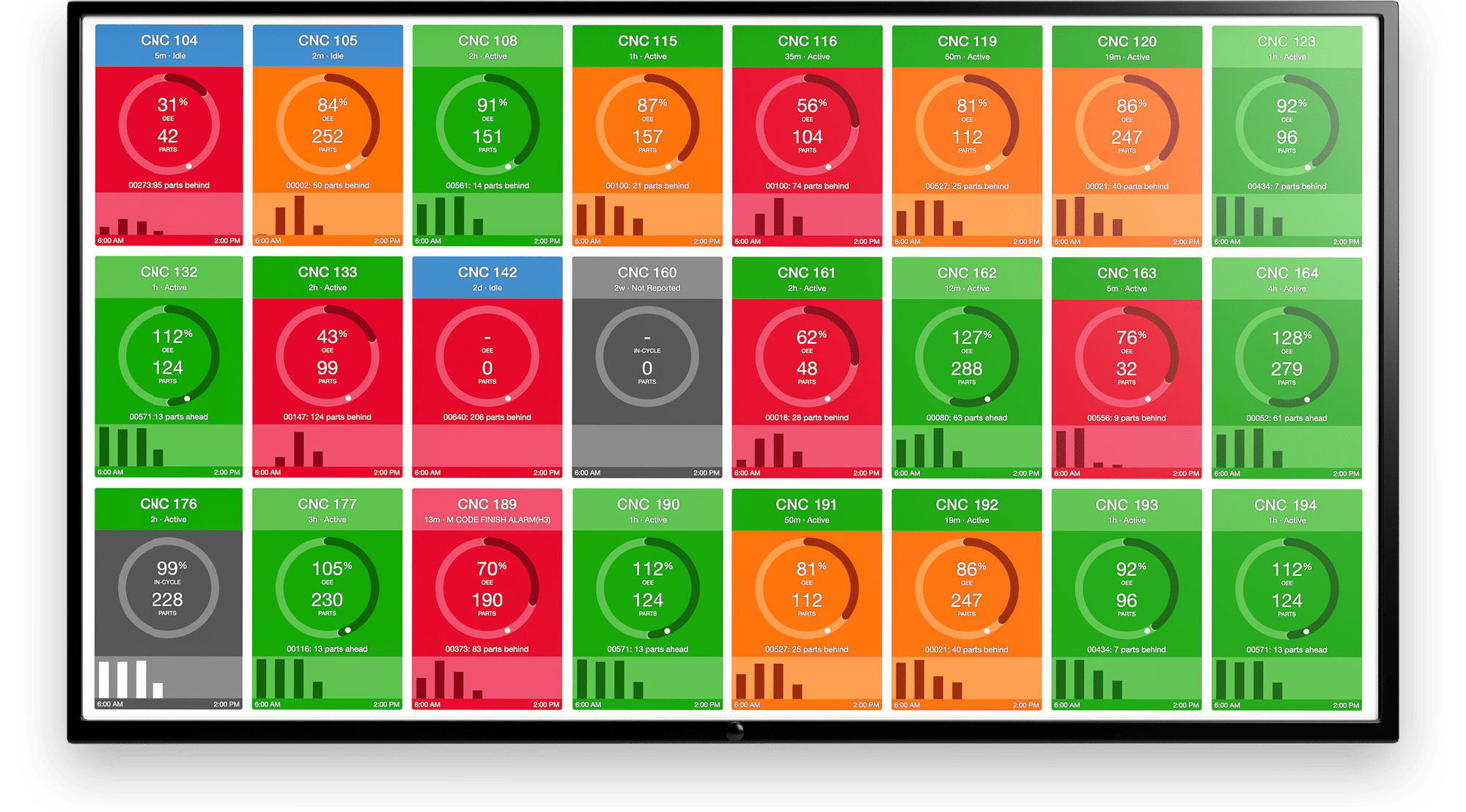

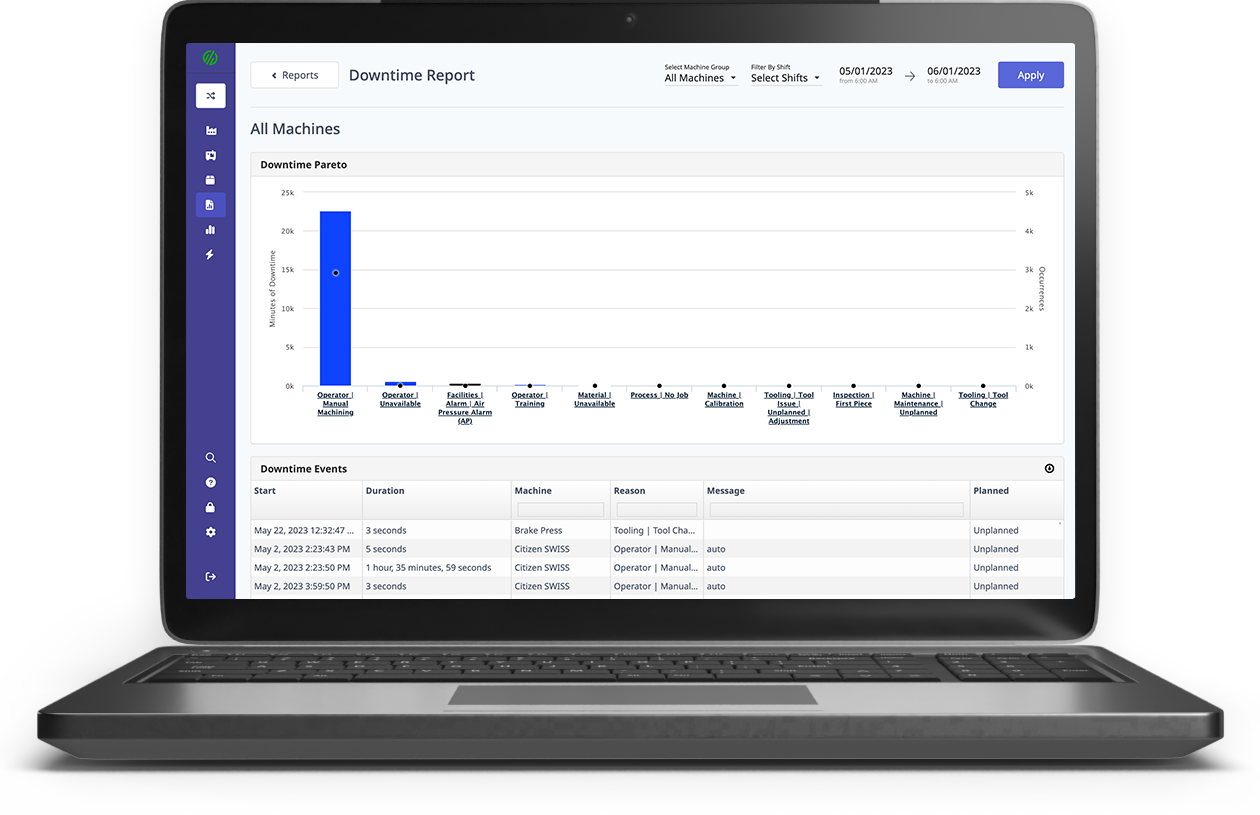

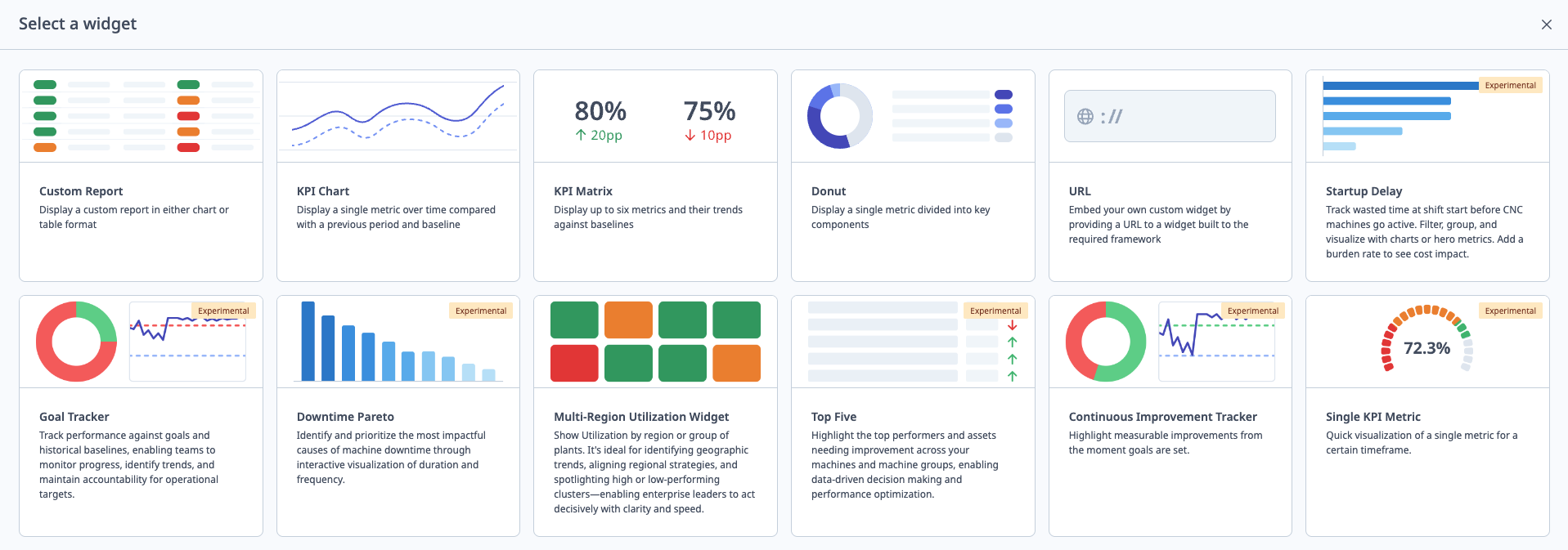

| Smart Factory Solutions |

Deploy Industry 4.0 solutions that attack hidden scrap and downtime, and identify process bottlenecks. |

Schneider Electric’s Lexington, KY smart factory cut conveyor downtime with AI-driven predictive maintenance, saving “hundreds of thousands” annually and supporting the firm’s $700 million U.S. expansion plan to hedge against looming metal and chip tariffs |

| Engineering and Design Tweaks |

Swap to lower-duty materials or redesign assemblies so the tariff-heavy component is added after import. |

Trane Technologies is substituting nickel-coated steel and aluminum tubing for copper line-sets inside its U.S. HVAC units to blunt the cost of an impending 25 % copper tariff. |

Recent reports share how leaders are reacting to the tariffs and trying to mitigate ongoing cost increased, with many focused on supply chain diversification and accelerated purchases.

According to the Federal Reserve Bank of Richmond, "Over 50 percent of manufacturing CFOs reported actively planning to diversify their supply chains, nearly 40 percent accelerated purchases in anticipation of tariffs, and a considerable share sought alternative foreign suppliers."

Action Checklist

What can you do (today) to start taking action? Here are a few next steps:

- Run a tariff-exposure audit: Map high-volume SKUs to HS codes, countries of origin, and duty rates, then tag any item whose exclusion expires within 90 days. Even a quick sweep pinpoints where the next cost jump could land.

- Model landed-cost scenarios: Run an exercise to determine baseline, +10 points, and worst-case scenarios - mapping out the impact from material cost to EBITDA.

- Fast-track supplier qualification: If a part looks vulnerable, speed up how you qualify a backup supplier. Aim for 30 days to do a quick quality check, another 30 days to finish the formal tests and paperwork, and have at least one tariff-free alternative approved.

- Stand up a tariff SWAT team: Pull in supply-chain, finance, ops, engineering, and trade-compliance for a bi-weekly pulse. Track duty dollars paid and the percent of parts that have backup suppliers.

Looking Ahead

It's likely tariffs will remain elevated at least through 2026, though Washington is carving out exceptions (such as credits to blunt auto-tariff pain). At the same time, Treasury officials hint at eventual de-escalation with China, acknowledging that 145 % tariff peaks are “unsustainable.”

With that said, there are some options for plant leaders: diversify and regionalize sourcing, squeeze every ounce of efficiency from your lines, and stay engaged in the policy process.

.png?width=1960&height=1300&name=01_comp_Downtime-%26-Quality_laptop%20(1).png)

.gif)

Comments