In recent years, many manufacturers have reconsidered their supply chain strategies and looked to reshore or nearshore critical segments. This trend is driven by various factors, including rising labor costs, ongoing disruptions in far-flung supply chains, inflation, new and stricter ESG initiatives, and more.

As countries vie to gain a competitive advantage in these new strategies, Mexico has emerged as a particularly appealing option for manufacturers looking to optimize their operations and protect their supply chains. Nearshoring resulted in $30 billion in direct investment from foreign manufacturers in 2022, and that number will continue to grow.

Why Mexico and Why Now?

There are many reasons why Mexico is a strategic and tactical location for manufacturing operations.

Labor Costs

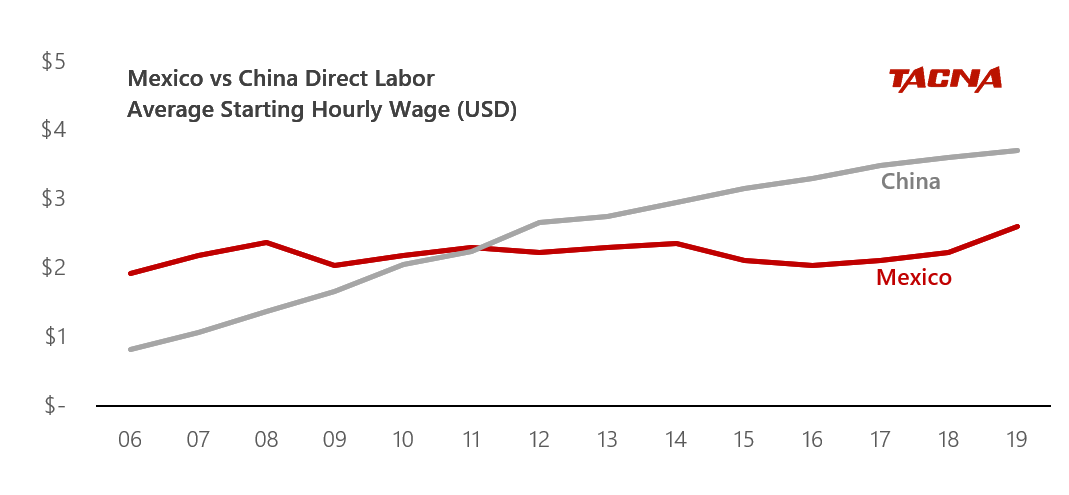

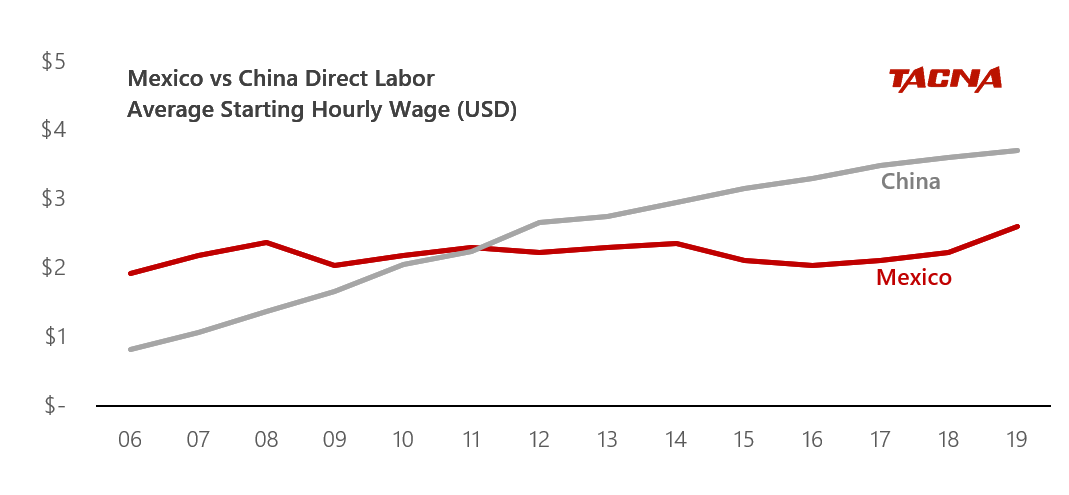

One of the main reasons manufacturers are reshoring or nearshoring their operations is the rising labor cost in traditional offshore destinations such as China. As wages continue to increase, the cost advantage of manufacturing in China has begun to diminish.

These increases have prompted many manufacturers to look at alternative locations where labor costs are lower but there is still access to a skilled workforce. Mexico fits that bill. With a large pool of highly skilled workers in engineering, IT, and manufacturing, many near-term problems caused by recent disruptions can be eliminated.

Image Source: Tacna

Image Source: Tacna

Ongoing Disruption

In recent years, natural disasters, geopolitical tensions, and the COVID-19 pandemic have highlighted the risks of relying on a single offshore supplier or country. By reshoring or nearshoring their operations, manufacturers reduce their dependence on a single-location supplier and gain greater control over their supply chain.

Mexico presents an attractive nearshoring destination for manufacturers because of its proximity to the United States. The United States-Mexico-Canada Agreement (USMCA) enables free trade between the three signatory countries by reducing tariffs and other trade barriers.

Nearshoring and Reshoring Convergence

Mexico's location makes it an ideal hub for regional distribution, as it allows manufacturers to quickly and efficiently transport goods to markets throughout North and South America. This regional advantage increases jobs on both sides of the border.

While only 4% of goods in China contain US-made components, 40% of those in Mexico do. This creates a synergy and builds confidence in the regional aspect, allowing Mexico to act as a nearshore and reshore component for some companies.

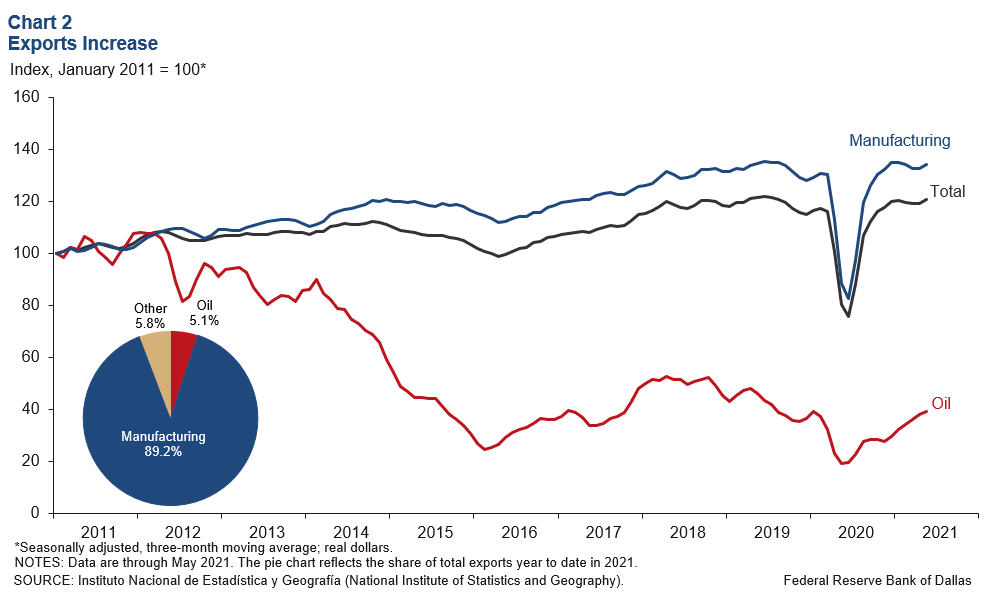

Manufacturing Infrastructure

Mexico has a history of manufacturing, a well-developed supplier network, and an extensive transportation and logistics infrastructure. Manufacturers can quickly set up operations in Mexico and tap into existing resources and expertise.

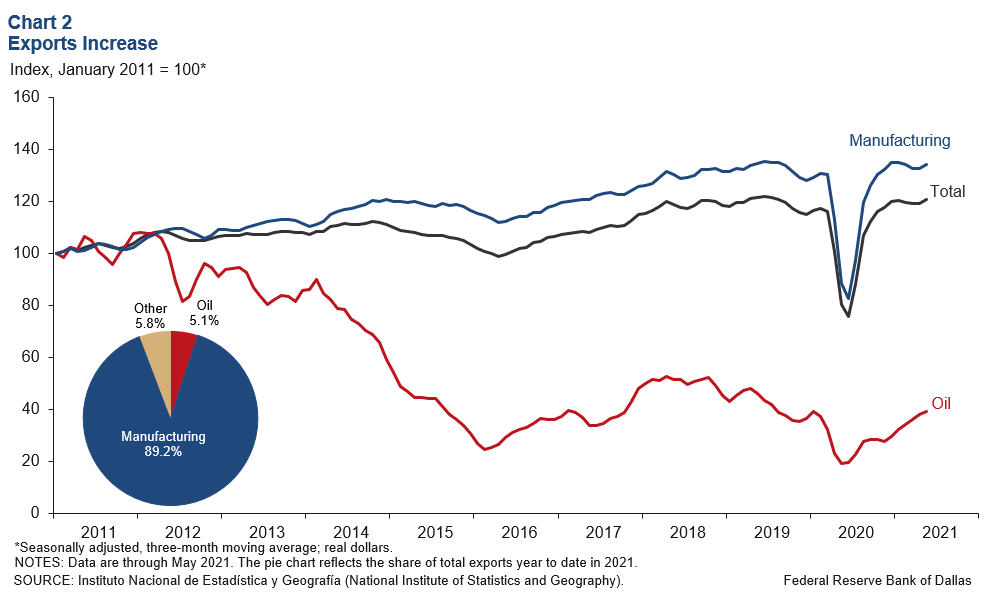

Total exports from Mexico. (Image Source: Federal Reserve Bank of Dallas)

Total exports from Mexico. (Image Source: Federal Reserve Bank of Dallas)

Lead Times

Transporting from China has traditionally taken at least a month. With port congestion and labor unrest, these times could increase depending on the time of year and political and economic conditions.

Mexico offers an opportunity to reduce lead time on materials and products. Its shared border and the ability to transit overland bypass port issues and remove a time-consuming and costly piece of transportation logistics from the equation. Goods from Mexico can take advantage of standard FTL and LTL distribution nodes that fit quickly into the US flow of goods.

Considerations for Reshoring and Nearshoring

Mexico does have its challenges. Concerns about crime and violence have been a deterrent for some investors. And while China offers low wage costs, Mexico has a more complex labor law structure that, while still much lower by US standards, often includes considerations for mandatory bonuses, codified profit sharing, and more.

However, nearshoring and reshoring remain viable solutions as companies seek to protect their supply chains and insulate themselves against disruption. Trends continue to bear this out, creating a 25% increase in jobs from 2021 to 2022. Both allow businesses to maintain their manufacturing processes close to home to respond to shifting market trends and consumer demand faster than overseas production.

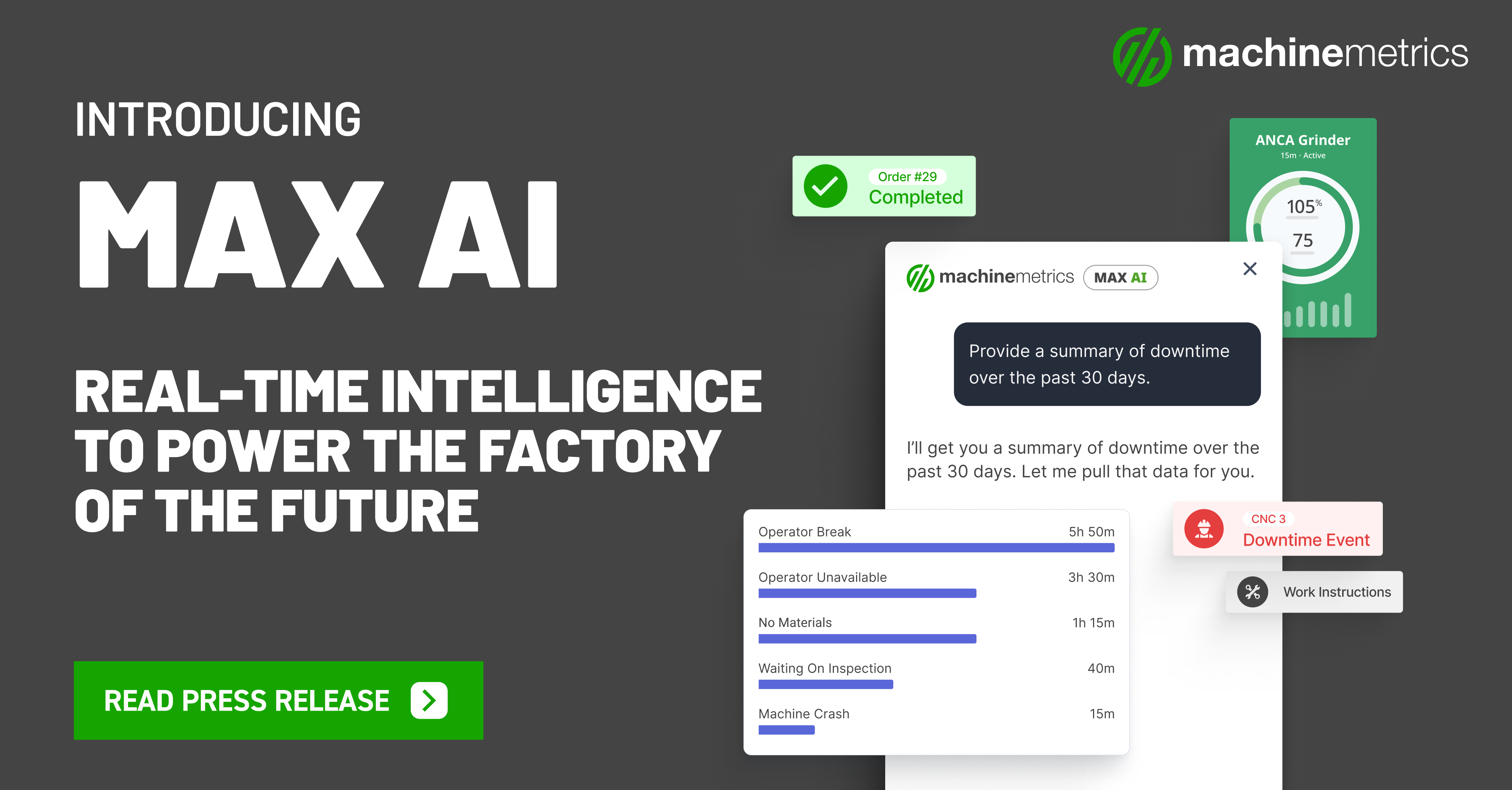

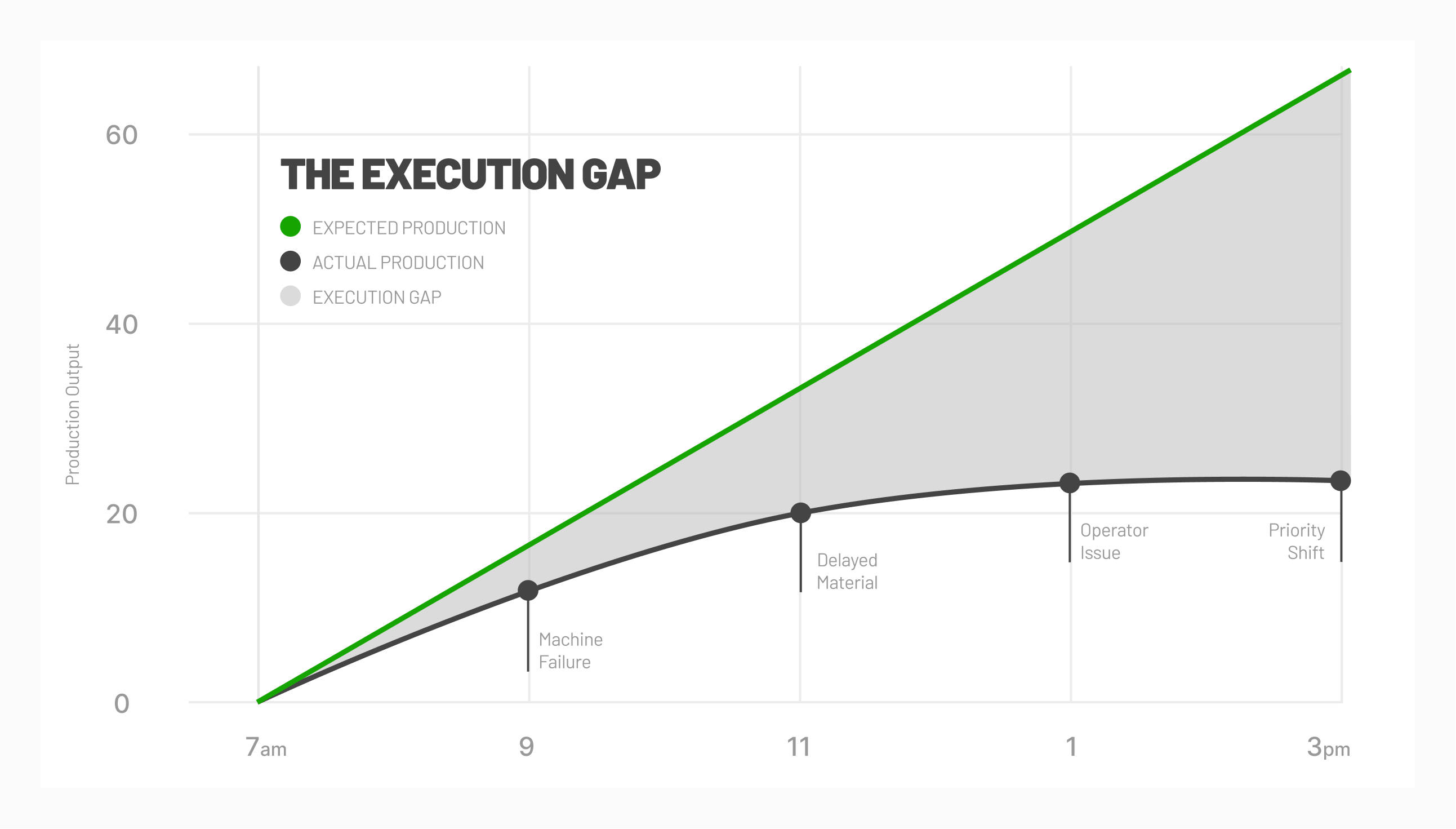

Using Machine Data to Drive Decision Making

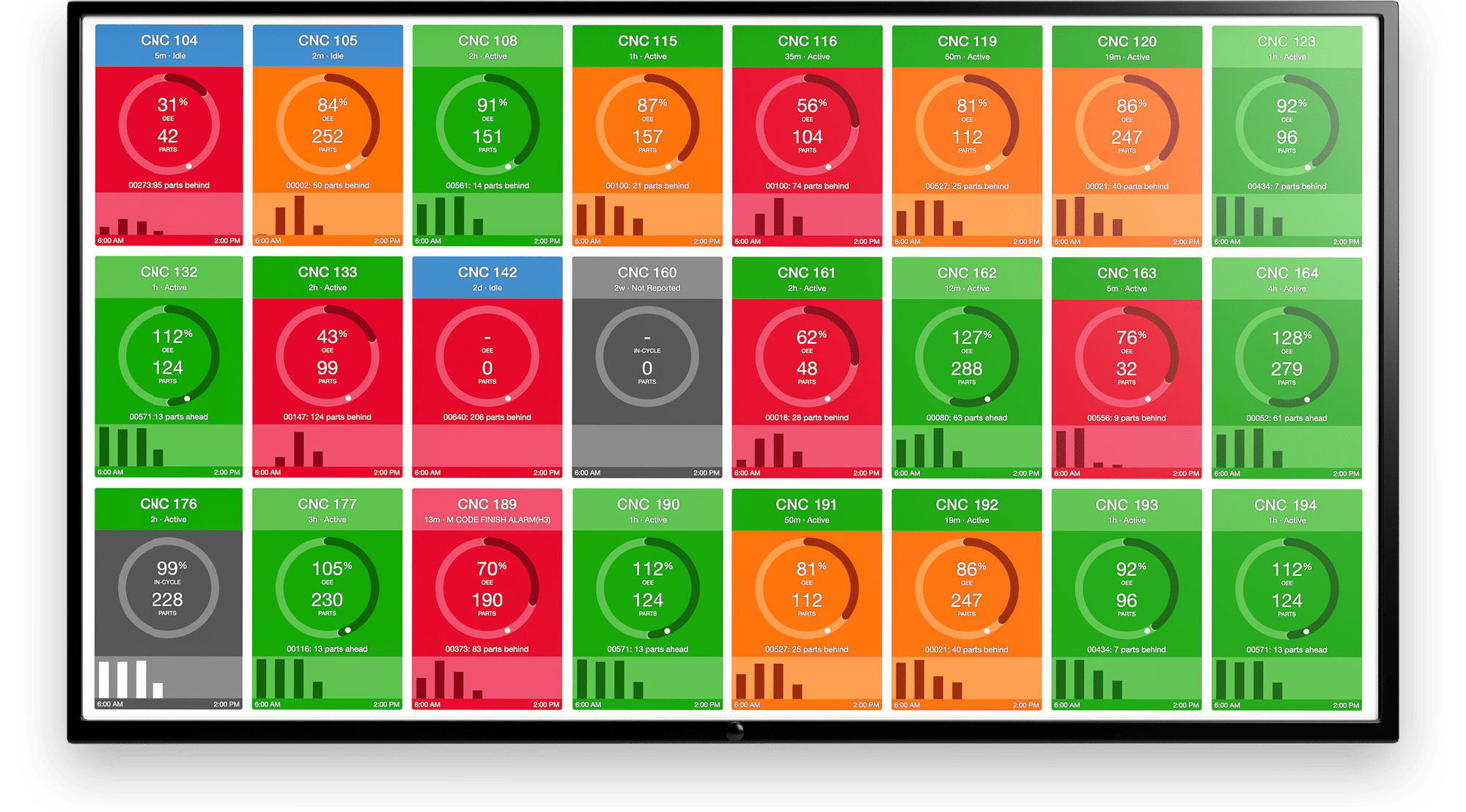

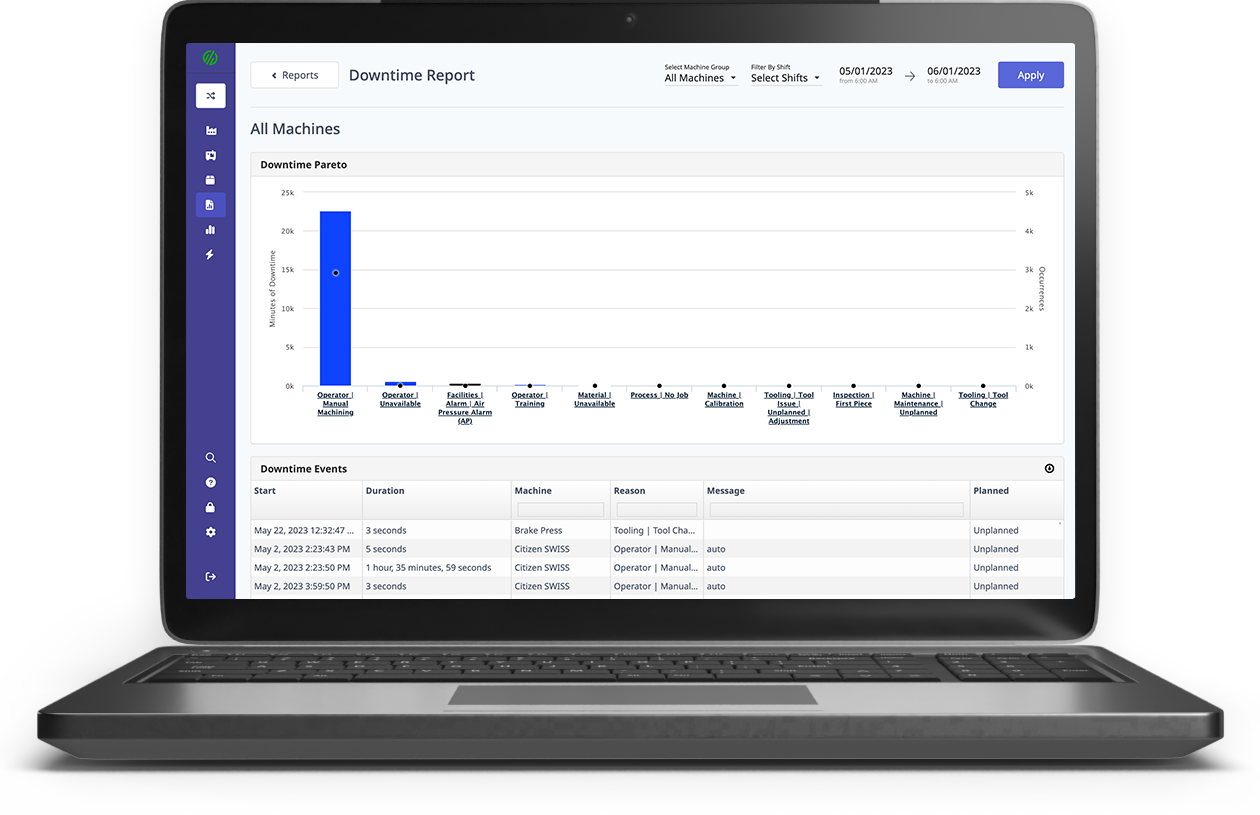

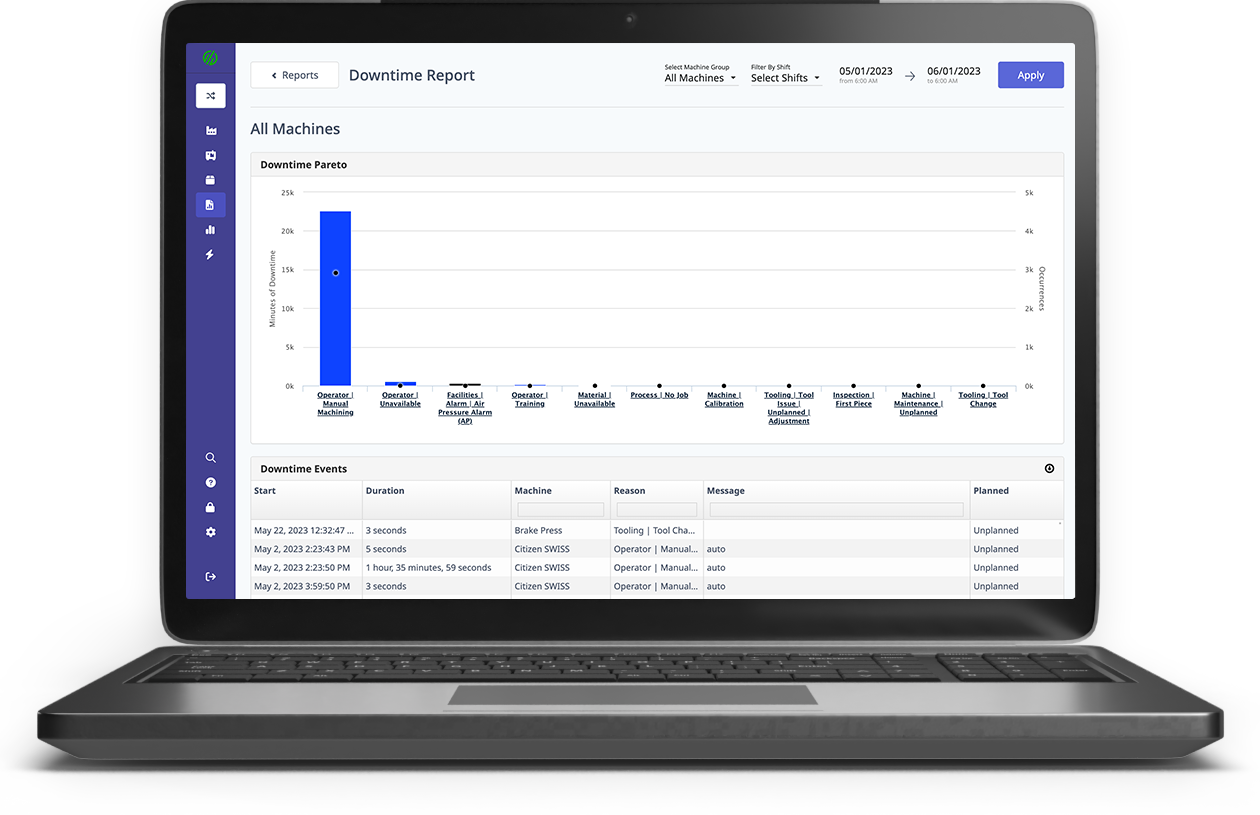

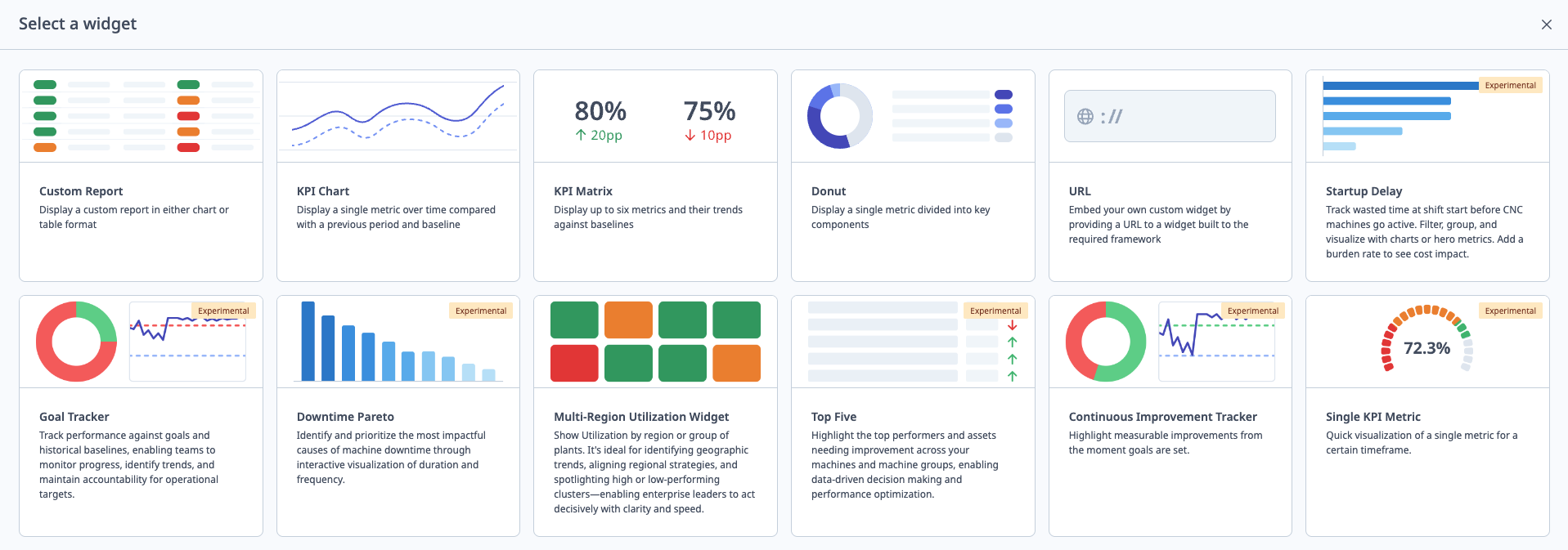

Take control of your machine data on either side of the border with a robust machine data platform that provides real-time visibility into your production process. MachineMetrics has hundreds of global customers, including Mexico.

The MachineMetrics platform can give you the insights you need to understand and optimize processes. The data can also be used to determine whether it makes sense to insource or outsource production.

Want to See the Platform in Action?

.png?width=1960&height=1300&name=01_comp_Downtime-%26-Quality_laptop%20(1).png)

.gif)

Comments